As a sales manager trying to manage multiple reps, each of whom might have dozens of open opportunities; it can feel like an uphill task to identify how much of that funnel is real. After all, you would have a responsibility to the boss and the board; and a duty to the company to properly forecast the business. This impacts cash flow projections, bank covenants, and a whole bunch of other grown up stuff.

Here are 10 ways to spot real deals from fakes. As a side note, if you get your sellers to focus on these identifiers, there is an awfully good chance your win rate will also improve dramatically.

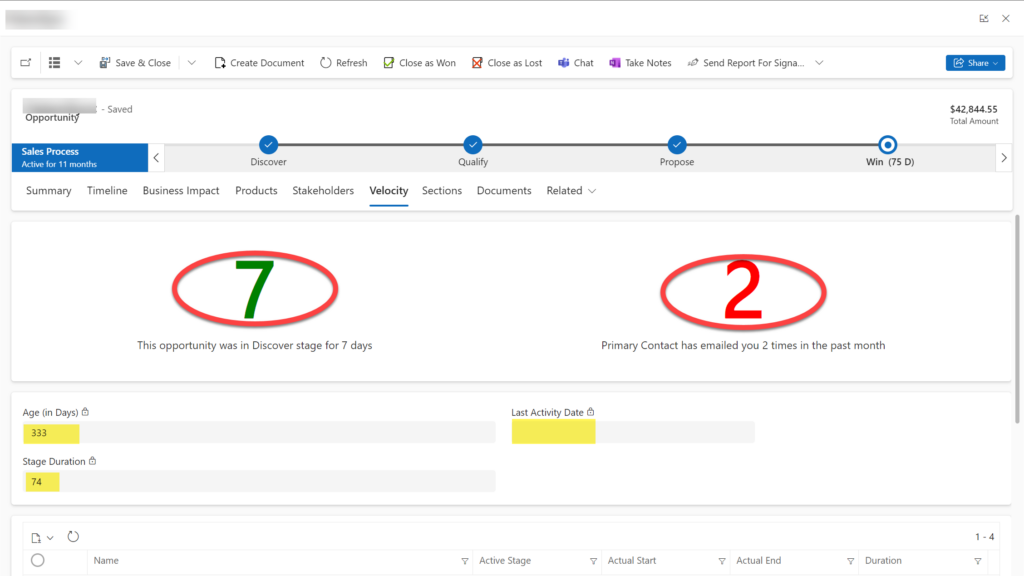

1) Exit Velocity: The opportunity escapes gravity

Assuming sellers are using their sales stages correctly, how quickly does the deal get out of the first stage? This is an important velocity indicator. A deal that gets created and moves out of the first stage in a short period of time is more likely to close (anecdotal fact we all know is true. A deal that is sitting in first stage for 180 days is garbage).

Despite what qualification process you use (ex. MEDDICC, BANT, or other), certain steps need to happen at the first stage. TekStack uses a four-stage opportunity process based on buyer activity, recommending the following:

| Create an Opportunity when: | Move out of first stage when: |

| Buyer Signal like expressed interest (ex. Demo) AND

Buyer Engaged (accepts meetings, replies to emails) AND Buyer Fit (Ideal Customer Profile) |

Rough Scope and budget alignment

Stakeholders are identified and profiled Buyer shows interest in continuing conversation after completion of first signal (ex. Demo) |

If a deal moves from Discover to Qualify in under 30 days, it has a higher probability to close than a deal that is in Discover for 180 days.

2) Engagement: The buyer is engaged with your seller

Sales opportunities should be activity based. If in the last 30 days a buyer is not being responsive, its unlikely that the deal is going to move forward. This is the second most important velocity indicator.

3) Fresh Test: We want Mozzarella not Manchego

If the age of this opportunity is older than the average sales cycle, then you need to question if it’s ever going to close. It’s not uncommon for sellers to ‘flag plant’ accounts with deals that may happen in the future, and this is a horrible practice for a number of reasons. First, a prospect account that has an open deal rarely ever receives marketing communication. Marketing might omit them from communication, so if your seller isn’t being diligent on the communication with the buyer, effectively you are not on the radar. Second, it bloats and ages your funnel, which makes it damn near impossible to trust it.

4) Slippery: Like a Fish

If a deal is ‘stuck’. That is, a deal hasn’t moved from its current stage in a while, then likely there is nothing happening on it, and it needs to get closed lost. For the same reasons above. What you want are deals that move between stages very quickly. These are slippery deals.

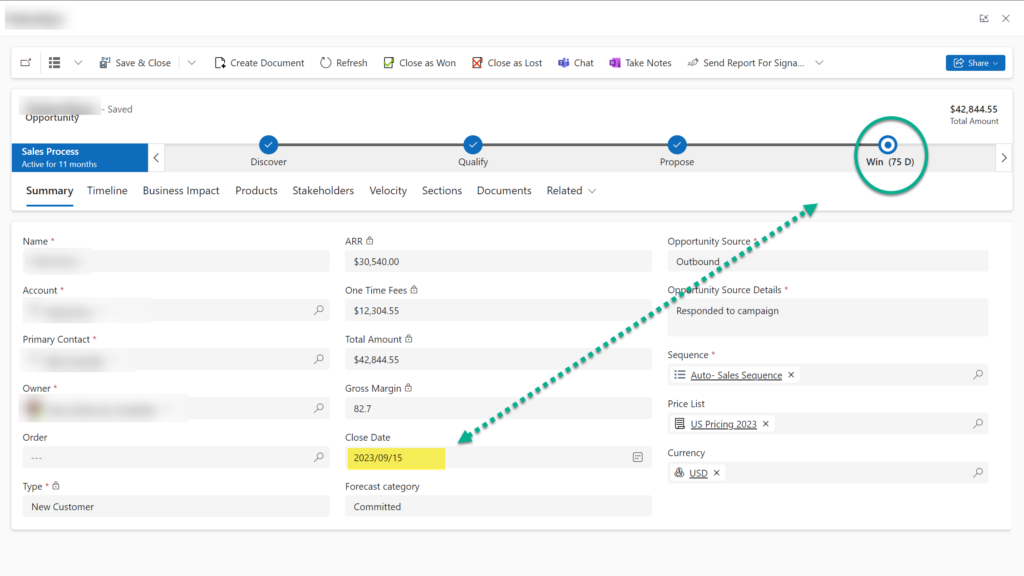

5) Activity: The deal has recent activity

If a deal hasn’t had any recent activity (ex. Phone Calls, meetings, or email with the contact) then its likely not going anywhere. TekStack tracks a last activity date so that a sales manager knows how if there is recent activity. This date is set automatically based on recent email, call, or appointment history with the buyer.

6) Alignment: Close Date and Deal Stages are aligned

If a deal is scheduled to close in 20 days, but its at the second of four stages, its likely not closing in 20 days. It’s more likely a seller hasn’t updated the opportunity in a while.

7) Stakeholders Identified: Seller has identified Stakeholders

If a seller only has one contact identified on a deal, it’s likely they are missing communication with other buyers. According to Forrester, 80% of B2B deals involve three or more buyers. If they aren’t identified, it means the seller isn’t doing the work. In TekStack you can identify stakeholders and also track communication across anyone in the account automatically. It’s a quick sniff test for a sales manager.

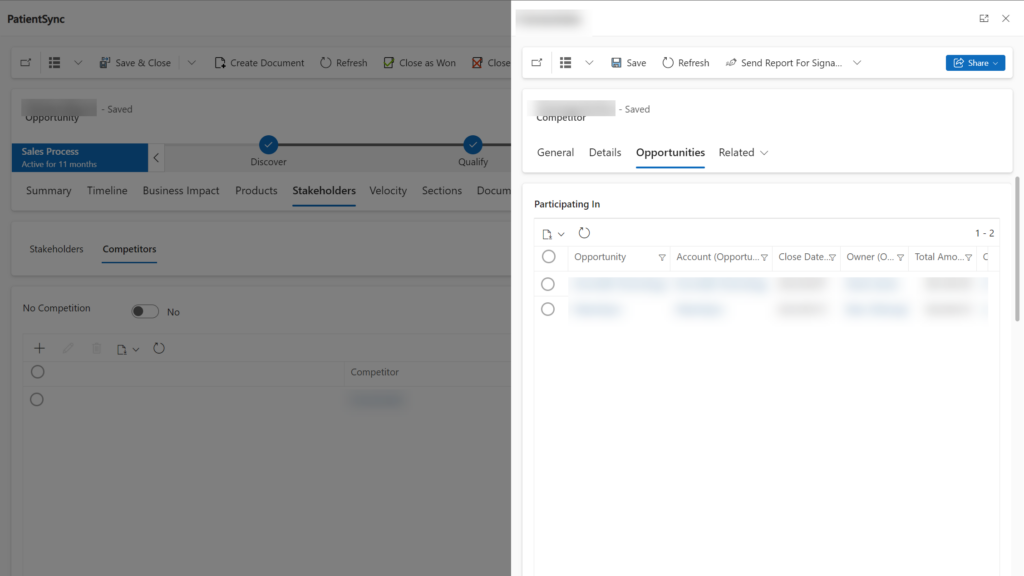

8) Competitors Identified: Seller has identified Competitors

Every deal is competitive. Incumbents, no decisions, legitimate alternatives. Every deal is up against something else. If a seller says there is no competition, call bullshit. Most companies will ironically have a lower win rate when a competitor is not identified on a deal. This is more indicative of poor qualification or poor sales work. TekStack allows you to track competitors on deals. Eventually you build a nice database of deals you’ve competed on with each competitor providing an aid to sellers who want to learn playbooks from other sellers, or contact buyers who chose you over a competitor.

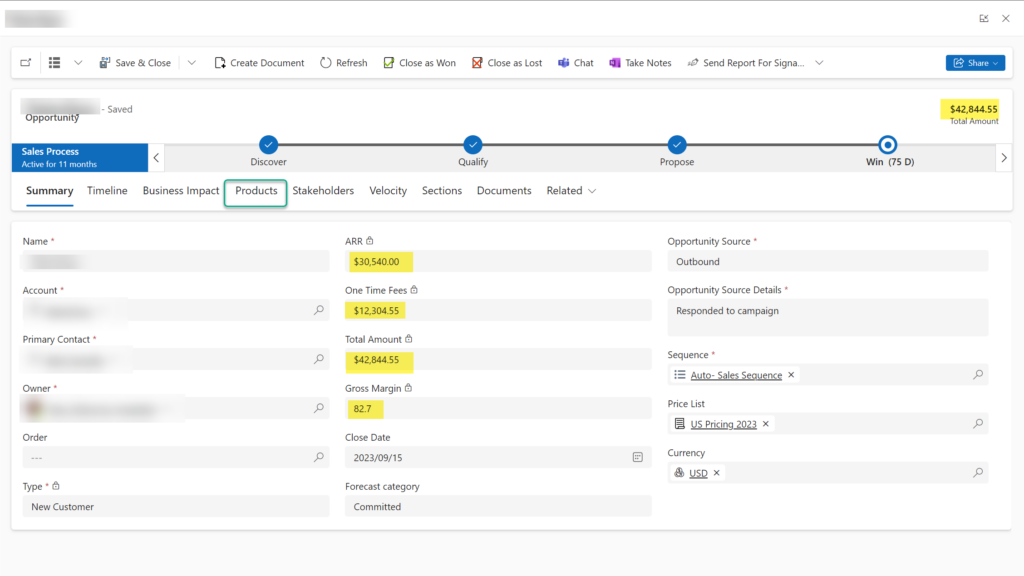

9) Opportunity Values: The are products on the opportunity

If a seller can’t clearly articulate what the buyer is buying, and can only quantify the deal loosely like “$200,000”; its unlikely they’ve had a conversation with a buyer. It’s not a big deal early stage, we don’t think early stage opportunities should have values associated with them. But if it’s a late stage opportunity without products or pricing, it’s probably at risk.

10) Articulated Problem Statement: Seller has identified Business Problems

Sellers that have articulated business problems in a narrative fashion are more likely to be successful with the opportunity. If they are unable to articulate in words they probably are struggling to align the value to the opportunity. Especially if they are working 10-40 deals. It doesn’t take long to forget key moments. The lack of this information is an indicator of how real the deal is.

Conclusion

When you can articulate the expectations you have on sellers, you’ll see a dramatic increase in win rate, you’ll also have a more accurate forecast for the business. The tough part is that most CRM systems need to be heavily customized to present this information to sales managers easily. That’s why TekStack has built all of these features into its sales opportunity management.